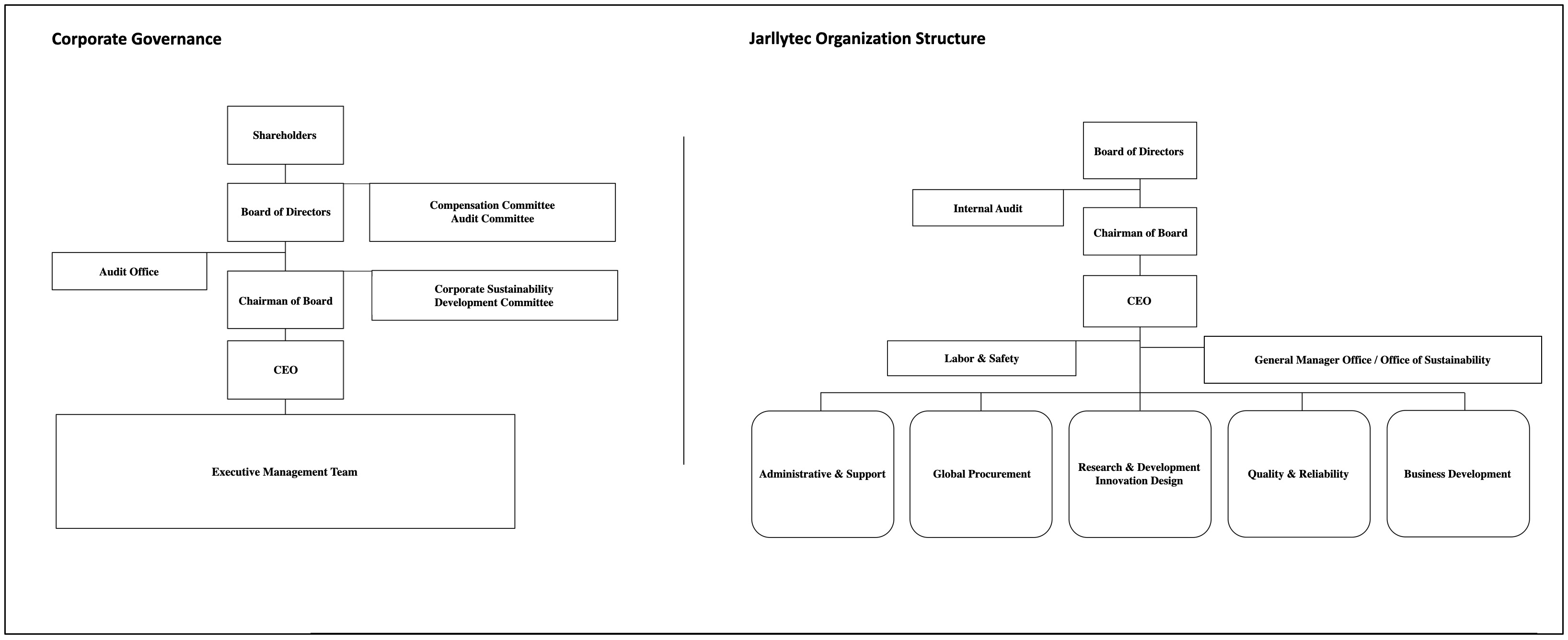

Corporate Governance

Board of Directors

Director term:June 18,2024~June 17,2027

| Title | Name | Experience |

|---|---|---|

| Chairman | Chang, Tai Yuan | General manager of JARLLYTEC CO., LTD. Master of Business Administration (EMBA) Taipei University |

| Vice Chairman | Liu, Kuang Hua | Chairman of JARLLYTEC CO., LTD. Master of Business Administration, EMBA of National Taiwan University |

| Director | Liu, Po Liang | Chairman of Quan An Technology Property Co., Ltd. Master of Chinese Culture University |

| Independent Director | Lee, Hsing Chin | Associate Professor, Department of Applied Foreign Languages, National Taipei University of Business |

| Independent Director | Wu, Sou Shan | Chair professor of National Taiwan Normal University PhD of Department of Finance, Insurance & Real Estate, University of Florida |

| Independent Director | Yang, Shang Hsien | Accountant of Cheng Yang CPAs Firm Department of Accounting, Tamkang University |

| Independent Director | Lee, Chien Ming | Vice general manager of TPK Co., Ltd. Master of Business Administration, EMBA of National Taiwan University |

The attendance of directors: http://mops.twse.com.tw/mops/web/t93sc03_1

The Board of Directors directs corporate strategy, oversees management, and remains accountable to the company and shareholders, ensuring all governance operations comply with laws, articles of incorporation, and shareholder resolutions.

Our company has established the "Corporate Governance Guidelines," which stipulate that the composition of the board of directors should take into account diversity. With the exception that directors concurrently serving as company executives should not exceed one-third of the total directorships, the guidelines further outline a policy for diversification based on the company's operations, business model, and development needs, establishing basic criteria and expertise in knowledge and skills.

The following is an excerpt from Article 20 of our company's "Corporate Governance Guidelines" regarding the policy on the diversification of board members: "The structure of the board of directors of our company should be determined based on the scale of business development and the shareholding situation of major shareholders, taking into account practical operational needs. The appropriate number of directorships should be decided to be five or more. Board members should consider diversification, and no more than one-third of the directorships should be held by directors concurrently serving as company executives.

Additionally, a suitable diversification policy should be formulated based on the company's operations, business model, and development needs. This policy should encompass, but is not limited to, the following two major aspects:

1.Basic qualifications and values: Gender, age, nationality, and culture

2.Professional knowledge and skills: Professional background (such as law, accounting, industry, finance, marketing, or technology), professional skills, and industry experience

All members of the board shall have the knowledge, skills, and experience necessary to perform their duties. To achieve the ideal goal of corporate governance, the board of directors shall possess the following abilities:

1. Operational judgment ability

2. Accounting and financial analysis ability

3. Management ability

4. Crisis management ability

5. Industry knowledge

6. International market perspective

7. Leadership ability

8. Decision-making ability

Jarllytech considers diversity in board members, in addition to their professional backgrounds. The company currently has seven directors, including four independent directors. One of the independent directors is female. The board members have a diverse range of professional backgrounds, including management, engineering, law, accounting, and industry management. The board members' knowledge and experience in different industries and academia can provide professional opinions from different perspectives, which is of great benefit to improving the company's operating performance and management efficiency.

The proportion of board members with employee status is 28.57%, and the proportion of independent directors is 57.14%. Jarllytech also pays attention to gender equality in the composition of board members. The target proportion of female directors is 25% or more. Currently, there are seven directors, including one female director, for a ratio of approximately 14.29%. All independent directors have served terms of less than nine years, and three directors are aged 60-75, while four are under 60.

Jarllytech directors and managers are required to participate in education and training on insider trading prevention management regulations and relevant laws and regulations at least once a year.In 2025, a one-hour training session on insider shareholding regulations was conducted for eight managers. New directors and managers are provided with timely education and training within three months of their appointment.

Pursuant to the "Internal Major Information Processing and Insider Trading Prevention Management Procedures" revised on August 9, 2023, Jarllytech regularly reminds directors and insiders not to trade stocks during the closed period of 30 days before the announcement of the annual financial report and 15 days before the announcement of the quarterly financial report.

On October 14, 2023, Jarllytech notified directors and insiders not to trade stocks during the closed period of 15 days before the announcement of the third quarter financial report of 2023.

On February 7, 2024, Jarllytech notified directors and insiders not to trade stocks during the closed period of 30 days before the announcement of the 2023 annual financial report.

In 2023, Jarllytech conducted relevant education and training for directors and managers for a total of 15 hours, covering insider trading, attribution rights, and shareholder changes.Notifications were issued on April 16, July 21, and October 21, 2025, to directors and insiders regarding stock trading blackouts 15 days prior to the release of Q1, Q2, and Q3 financial reports.

Jarllytech Succession Plan:

The company's succession plan requires that successors not only have the ability to work, but also have values that are consistent with the company. The personality traits required include leadership, interpersonal skills, communication skills, innovation, integrity, commitment, and the ability to win customer trust. Currently, the company is implementing the succession plan. The former chairman, Liu, has stepped down as vice chairman to assist the new chairman, Chang, Tai-Yuan. Chang, Tai-Yuan will continue to serve as general manager for a short period of time. Within five years, one of the five current vice presidents and assistants will be selected to succeed the general manager position, depending on the company's development needs.

The training model for successors to senior management positions in the Jarlly Group is divided into four modules: management skills, professional skills, personal development plan, and job rotation. Each module is planned to take approximately 1-1.5 years. Through professional skills training, trainees can integrate and apply their knowledge and skills to develop decision-making judgment. The Jarlly culture is to give priority to giving opportunities to internal employees who are prepared, unless there is still no suitable candidate at that time, in which case the company will look for a suitable professional manager.

Committee

Remuneration Committee

To ensure a sound remuneration system for the company's directors, supervisors, and managers, the company has established a remuneration committee in accordance with the Regulations Governing the Establishment and Exercise of Powers of Remuneration Committees of Companies Listed on the Stock Exchange or Traded in Securities Trading Places. The company's remuneration committee was established on December 27, 2001, with three members. The committee meets at least twice a year. The members are appointed by the board of directors, and one of the members is elected by the members to serve as the convener. The convener represents the committee to the outside world. The term of office of the members of the committee is the same as that of the board of directors that appointed them. The committee shall faithfully perform the following powers with the care of a prudent manager and submit the suggestions to the board of directors for discussion.

1.Regularly review this regulation and propose amendments.

2.Establish and regularly review the company's annual and long-term performance goals and remuneration policies, systems, standards, and structures for directors and managers.

Regularly assess the company's directors' and managers' performance goal achievement and set their remuneration.

Remuneration Committee term: June 18,2024~July 17,2027

| Title | Name | Experience |

|---|---|---|

| Independent Director | Yang, Shang Hsien(Chairman) | Accountant of Cheng Yang CPAs Firm Department of Accounting, Tamkang University |

| Independent Director | Wu, Sou Shan | Chair professor of National Taiwan Normal University PhD of Department of Finance, Insurance & Real Estate, University of Florida |

| Independent Director | Lee, Hsing Chin |

Associate Professor, Department of Applied Foreign Languages, National Taipei University of Business |

For information on Compensation Committee meetings, please refer to: http://mops.twse.com.tw/mops/web/t100sb03_1

Audit Committee

To strengthen the company's corporate governance, the company has established an audit committee to replace the supervisory board in accordance with the provisions of Article 14-4 of the Securities Transaction Act. The committee has four members and meets at least once a quarter.。

The committee is composed of all independent directors. The members elect one of their members to serve as the convener.

The term of office for independent directors of the committee is three years, and they may be re-elected.

The committee's responsibilities are as follows:

1. To establish or amend the internal control system in accordance with Article 14-1 of the Securities Transaction Act.

2. To evaluate the effectiveness of the internal control system.

3. To establish or amend the procedures for handling major financial transactions, such as the acquisition or disposal of assets, derivative transactions, lending to others, and providing guarantees for others, in accordance with Article 36-1 of the Securities Transaction Act.

4. Matters involving the interests of directors themselves.

5. Major asset or derivative transactions.

6. Major loans, endorsements, or guarantees.

7. The issuance or private placement of securities with equity characteristics.

8. The appointment, dismissal, or remuneration of certified public accountants.

9. The appointment or dismissal of financial, accounting, or internal audit managers.

10. The first, second, and third quarter financial reports and annual financial reports.

11. Other major matters as prescribed by the company or regulatory authorities.

The company's audit committee was established on June 21, 2018, with four members. The term of office for the current committee members is June 18, 2024 to June 17, 2027.

| Title | Name |

|---|---|

| Independent Director | Yang, Shang Hsien(Chairman) |

| Independent Director | Wu, Sou Shan |

| Independent Director | Lee, Chien Ming |

| Independent Director | Lee, Hsing Chin |

Internal Audit

- The appointment or dismissal of the company's internal audit manager is handled in accordance with the Securities Transaction Act. The appointment, evaluation, and remuneration of internal audit personnel are handled in accordance with the provisions of the "Employee Recruitment and Appointment Procedures" and the "Termination Management Regulations." Evaluations are conducted twice a year. The above appointments, evaluations, and remuneration are submitted to the chairman for approval in accordance with the approval process.

- The company's audit department is an independent unit that is subordinate to the board of directors. It is responsible for the inspection and evaluation of the company's internal control, in order to promote the company's operating performance.

- The company's audit department has one internal audit manager. In addition to meeting the qualifications required by the Securities and Futures Commission, the internal audit manager also continues to take professional courses related to internal audit every year. The list of internal audit personnel is submitted to the Taiwan Stock Exchange Corporation (TWSE) by the end of January every year.

- The company has established the company's internal control system in accordance with the "Processing Guidelines for the Establishment of Internal Control Systems for Publicly Listed Companies" issued by the Securities and Futures Commission. This system serves as the basis for the implementation of internal auditing. The audit department annually establishes an annual audit plan to inspect and evaluate the implementation of internal control and provide timely improvement suggestions to ensure that the internal control system is continuously and effectively implemented. The annual audit plan and the implementation of the audit plan have been submitted to the TWSE in accordance with regulations.

Summary of Communication Between Independent Directors and Internal Audit Chief:

|

Date |

Meeting |

Key points of communication |

Note |

|

2025/01/17 |

Board of Directors |

Audit Business Execution Report for

November 2024 to December 2024 |

None |

|

2025/03/07 |

Board of Directors |

1. Audit Business Execution

Report for January 2025 to February 2025 |

None |

|

2025/05/09 |

Board of Directors |

Audit Business Execution Report for

March 2025 to April 2025 |

None |

|

2025/08/11 |

Board of Directors |

Audit Business Execution Report

for May 2025 to July 2025 |

None |

|

2025/11/11 |

Board of Directors |

1.Audit business execution report August

2025 to October 2025 |

None |

|

2025/11/11 |

Meeting between Independent Directors

and Audit Staff |

Third Quarter of 2025 Audit Business

Execution Report and Communication |

None |

Integrity management/sustainable development

| Project | Operational situation | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sustainable development | The company has set up a "Social Responsibility Implementation Committee". The chairman of the board appoints the general manager as the social responsibility management representative, responsible for supervising the operation of the social responsibility management system. It has a general manager, an executive secretary, and representatives from each department who are familiar with department operations and social responsibility issues. person, serving as executive committee member and executive director. The Social Responsibility Implementation Committee is responsible for reviewing social responsibility policies, budgets and goals; managing, supervising and promoting the implementation of social corporate responsibility-related issues; reporting the implementation status and operational results to the board of directors every year, hoping to effectively integrate the company's internal and external resources to systematically and The organized operation method helps the company gradually develop in the direction of sustainable management.

Based on the principle of materiality, the company conducts risk assessments on environmental, social and corporate governance issues related to the company's operations, and formulates relevant risk management policies or strategies as follows:

|

||||||||||||

| Business integrity management | The Group Human Resources Department is responsible for the promotion and implementation of corporate ethical management. In order to prevent conflicts of interest and provide appropriate reporting channels, the "Code of Integrity Business" was established by resolution of the board of directors on May 7, 2014, and was approved by the board of directors on March 12, 2019, in order to cooperate with the company's actual operations and comply with legal requirements. Revised and submitted to the shareholders' meeting on June 18, 2019. The General Management Office publishes regular reports every year (the most recent report to the Board of Directors was on January 17, 2025). Report its implementation status to the board of directors (for example: education, training and complaint system implementation status). In 2024 years, 6,424 people and 9,814.75 hours of internal and external education and training related to integrity management issues (such as courses on integrity management, corporate governance, accounting systems, internal control, etc.) were held. In terms of the complaint system, the company has "complaints and personal rights protection operating procedures", and has a complaint acceptance telephone number and a report mailbox as complaint channels. Complaints can be reported through the phone and mailbox or to the general management office, audit office or finance department. |

Information Security Policy

Information Security is Everyone's Responsibility

- To ensure the lawful access of the company's information, and to provide complete and uninterrupted operation of the information system in the event of external intrusion.

- To resume normal operation as quickly as possible after taking necessary and prompt measures in the event of an accident, in order to minimize the damage that the accident may cause.

Information Security Management Policy:

- Establish an information security implementation system.

- Prevent improper behavior.

- Protect customer information.

- Prohibit improper acquisition of information.

- Promote and implement information security policy.

- Conduct regular inspections and improvements.

- Prohibit the incorrect use of information.

- Comply with laws and regulations.